Track, plan and analyse with Money Management

Our financial management package brings together all the tools and tech you need to manage your business finances. To access the Money Management service, you'll need to be a registered user of Business Internet Banking.

Extra digital tools for busy businesses

With Money Management, spend less time on financial admin and more time growing your business.

This extra service integrates into your business internet banking, offering even more great features focused on financial management. Get insights into where you're spending, plan ahead with smart forecasts, and even create and manage invoices. With interactive features, graphs and charts, Money Management makes it easy to understand and manage your business finances.

How Money Management can support you

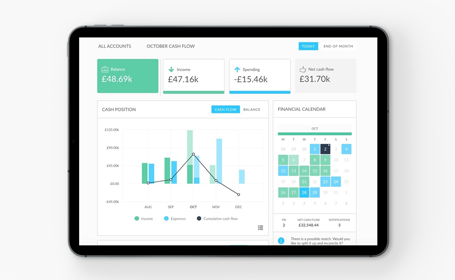

Forecast with financial calendars

This heatmap gives a long-term overview of cash going in and out each day for the next year, helping you to plan ahead.

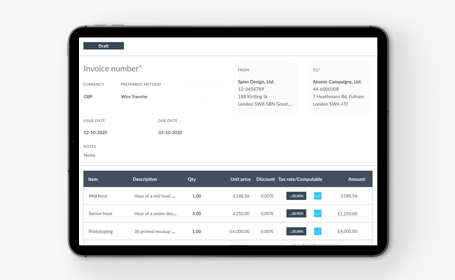

Invoice creation and management

Save time by creating invoices from within the platform itself. You can also save received ones and clearly see which invoices are paid, unpaid or overdue.

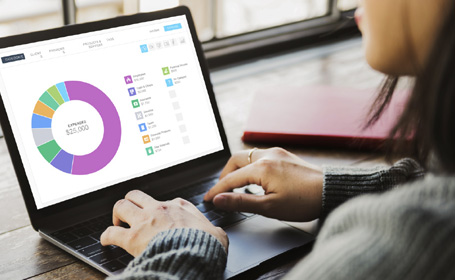

Budgets made simple

Set a budget which will update automatically with each transaction you make. And choose from at-a-glance or detailed spending vs. budget view.

Transaction categorisation

Understand and track your business spending by filtering transactions by time period, client, provider or category.

Smart cashflow projection

Stay on top of money coming in and going out, and get cashflow forecasts based on your actual spending.

What to expect with Money Management

Popular questions about Money Management

What is Money Management?

Money Management is a digital tool that helps you to keep track of all your business finances. It includes handy features for categorising transactions, projecting revenue and spending, creating and managing invoices and also managing budgets.

How do I access Money Management?

- Log in to Business Internet Banking

- Select the Products tile and from there choose Money Management

- Fill out the application form and click submit

- You'll be able to access the Money Management service on your account the next working day. Keep an eye out for an email telling you that you've been given access

How much does Money Management cost?

Money Management is free to all Business Internet Banking customers. If you don’t have access to Business Internet Banking, sign up here and once that’s complete pop back to this page to register for Money Management.

How do I cancel Money Management?

Simply call us on 0800 756 0800 and one of our agents will cancel the service for you.

What can I do on Money Management?

Money Management helps you spend less time on financial admin, and more time growing your business. It includes:

- Transaction Categorisation. Transactions are sorted into categories like travel or utilities, plus you can filter by client or provider.

- Budgets Made Simple. Set monthly budgets which update in real time with each transaction you make.

- Forecast with Financial Calendars. Plan ahead and track your spending patterns. This heatmap overview shows cash going in and out, each day, for the next year.

- Smart Cashflow Projection. Using an analysis of historic, actual and forecasted spending, you can get a better idea of your future cashflow.

- Invoice Creation and Management. Manage your incoming and outgoing invoices, and create invoices quickly and easily from within the platform.

Get Money Management

-

You can sign up for Money Management from your Business Internet Banking account. Once logged into your account, you'll find the Money Management service on the Products menu.

-

Not using Business Internet Banking yet?

Get in touch

-

If you'd like to speak to someone, give us a call

We're here Mon-Fri 8am-6pm

You can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.