Small businesses surge as latest report shows recovery from Q2 declines

< back to all business news articles

11/12/2019

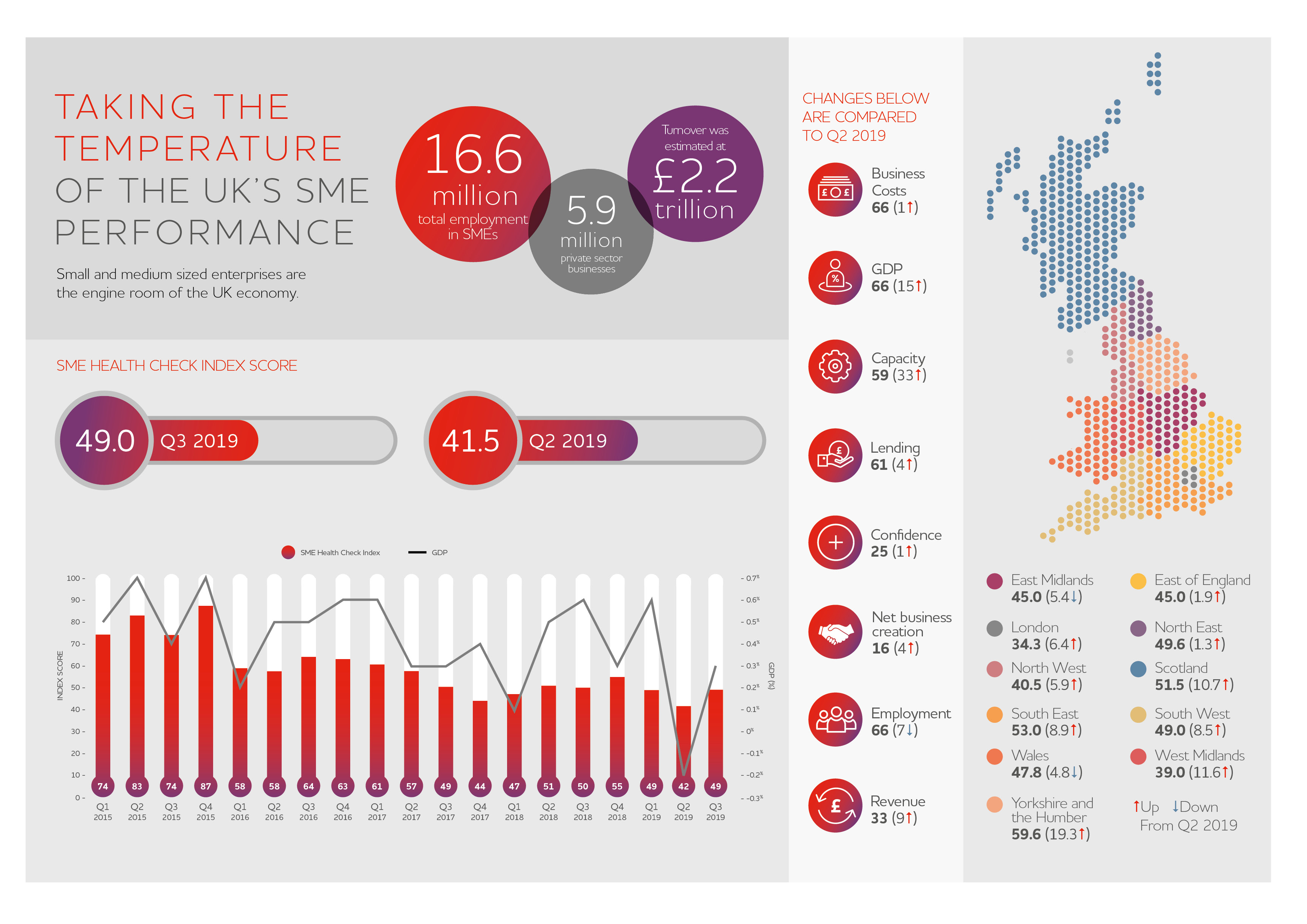

Latest SME Health Check Index shows recovery in third quarter of 2019

- Overall Index score rises 7.5 points from the second quarter to reach 49.0 in Q3

- Increases recorded in all indicators except employment – driven by the slowdown in employment growth

- Yorkshire & Humber and the West Midlands see biggest increases; Wales and East Midlands only regions to see a decrease in Index scored

- Research shows 3 in 4 SMEs have experienced late payments from customers in the past year, causing disruption for their business

Despite an intense political climate and uncertain economic ground over the third quarter of this year, business confidence is stable. This is reflected in the latest SME Health Check Index, which shows a bounce back from the lowest ever recorded score in Q2.

The report from Virgin Money UK, owner of Clydesdale and Yorkshire Bank (formerly CYBG), showed that in Q3, the Index rose 7.5 points to 49.0. This is across eight indicators; measuring business costs, GDP, employment, revenue, capacity, confidence, lending and net business creation.

The positive increase in the score demonstrates the uptake in economic activity, slowdown in the rate of cost inflation (which fell to its slowest pace since 2017), decline in cost of commercial rents and consistency in the price of tangible assets.

The only indicator to see a decline was employment growth, which saw the annual rate of employment growth drop by 0.3 percentage points to 1.0%.

Gains in the SME Health Check Index were recorded in nine of the eleven regions covered, with SMEs in most parts of the country benefitting from the rebound in economic activity in Q3.

Yorkshire & Humber and the West Midlands saw the most sizeable improvements, with increases of 19.3 and 11.6 points respectively in the SME Health Check Index. Both of these regions managed to buck the national employment trend in Q3, with each experiencing an acceleration in the annual rate of employment growth.

The only two regions to record a decrease in the SME Health Check Index in Q3 were Wales and the East Midlands. The Index score for Wales was dragged down by a 1.6% annual contraction in the number of people in employment, while the East Midlands’ score was adversely impacted by a fall in the share of SMEs that reported an increase in revenues over the past month.

A special report this quarter focused on late payments shows that 3 in 4 SMEs (74%) have experienced late payments from customers over the last 12 months. The survey of 1,000 senior SME decision-makers shows 13% of payments in the last year were received later than the agreed payment terms, causing disruption for businesses, including needing to postpone investment and causing difficulty in paying staff. The report also shows the knock-on effect of late payments, with 88% of SMEs who have paid a supplier late saying that a late payment due from a customer was a contributing factor.

Gavin Opperman, Group Customer Banking Director, at Virgin Money UK, said: “The Q3 SME Health Check results show cause for optimism. After a challenging start to the year, UK SMEs are showing definite signs of recovery. There are undoubtedly challenges to navigate, and political uncertainty remains a thorn in our economy’s side.

“However, here at Virgin Money we are committed to helping UK SMEs prosper and grow, and with the right strategy and adequate support, we feel confident they can continue on a positive track.

“The special report this quarter highlights the problem of late payments which has long impacted the SME sector. The Government has recently announced new plans to tackle the problem, promising to strengthen the role of Small Business Commissioner, but more can be done. Virgin Money supports the Federation of Small Businesses’ Fair Pay Fair Play campaign and we urge other businesses – particularly large organisations – to support the campaign.”

POSTED IN: 2019

SHARE

Related Articles

You can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.