LIBOR Transition

Frequently Asked Questions

These FAQs have been prepared to support customers during LIBOR Transition. We will update this information on a regular basis as regulatory and market guidance and approaches evolve. These FAQs seek to provide general guidance, but please note some of the content may not be relevant or specific to your individual circumstances.

If you need more help, please contact our LIBOR transition specialists at CYBG LIBOR Transition Programme.

Background

What are benchmark rates?

Benchmark interest rates, also known as interest rate benchmarks and reference rates, are widely used across the global economy for calculating interest rates and valuations in relation to a wide variety of financial contracts, such as derivatives, bonds, loans and consumer lending products. Interest rates can be fixed or calculated by reference to benchmark rates.

What is benchmark reform?

Since 2014, financial institutions worldwide have been moving towards replacing or reforming benchmark rates in what is known as Benchmark Reform. A key focus of these reforms is to ensure that widely used benchmarks are credible and robust. Regulators have been clear that this means benchmarks should be based upon transactions to the greatest extent possible.

New benchmark rates are designed to be risk-free reference rates (RFRs) and are largely based on actual transactions with minimal reliance on expert judgement from contributing banks. As a result, new and reformed benchmarks will be more transparent and reliable.

What is LIBOR?

The London Interbank Offered Rate (LIBOR) is an indication of the average rates at which banks could obtain wholesale, unsecured funding. It is calculated and published daily across five currencies (GBP, USD, EUR, JPY and CHF) and seven tenors (overnight, one week, and 1, 2, 3, 6 and 12 months). LIBOR is based on submissions by a panel of banks using available transaction data and their expert judgement. Each panel bank estimates what it would be charged if it were to borrow from other banks and an average is calculated from these estimates.

As there has been a significant decrease in the number of transactions on the underlying market that LIBOR represents, this rate has become more dependent on the expert judgement of the panel banks.

Clydesdale Bank is not a panel bank.

Why is LIBOR being phased out?

Due to the increased reliance on expert judgement rather than underlying transaction data, market confidence in the use of LIBOR as a benchmark has reduced, leading regulators globally to encourage market participants to move towards alternative risk-free reference rates.

The Financial Conduct Authority (FCA) announced on 5th March 2021 the dates that panel bank submissions for all LIBOR settings will cease, after which representative LIBOR rates will no longer be available.

When will LIBOR end?

The Financial Conduct Authority confirmed on the 5th March 2021 that all LIBOR settings will either cease to be provided by any administrator or no longer be representative:

- Immediately after 31st December 2021, in the case of all Sterling, Euro, Swiss Franc and Japanese Yen settings, and the 1-week and 2-month US Dollar settings; and

- immediately after 30th June 2023, in the case of the remaining US Dollar settings.

Synthetic LIBOR and Tough Legacy

The FCA will be consulting on using proposed new powers, which the Government is legislating to grant them under the Benchmarks Regulation as part of the Financial Services Bill (FS Bill), for the continued publication of a small number of LIBOR settings, including 1, 3 and 6-month sterling LIBOR, on a non-representative, ‘synthetic’ basis. This is being done because authorities recognise that there are some existing LIBOR contracts which are particularly difficult to amend, often known as ‘tough legacy’. The FS Bill has been introduced into Parliament and is subject to debate and consideration before it may be enacted.

The FCA will continue to consider the case for using these powers for the 1-month, 3-month and 6-month US dollar LIBOR settings when the US dollar LIBOR panel ends in June 2023, but market participants should not rely on them doing so.

The FCA has stated that any synthetic LIBOR setting will not be representative and is not to be used in new contracts. It is intended for use in tough legacy contracts only.

Further details can be found below:

FCA announcement on future cessation and loss of representativeness of the LIBOR benchmarks

Benchmarks Regulation: our new powers, policy and decision-making

Alternative Rates

What alternative reference rates can be used instead of LIBOR?

LIBOR rates are calculated for sterling and a further four currencies. Each LIBOR jurisdiction has its own working group. These working groups have identified replacement reference rates as follows:

One specific reference rate will not be the solution for all current LIBOR priced products. In sterling markets, alternatives are Bank of England Base Rate or a SONIA-derived rate, with the appropriate rate being determined by individual customer circumstances. A fixed rate may also be an option for some customers.

The Euro Interbank Offered Rate, known as EURIBOR, is a similar reference rate derived from banks across the Eurozone, and is the reference rate used by Clydesdale Bank for our euro-denominated facilities. There are no current plans to discontinue EURIBOR. Further information can be found at Question 7.

Are other reference rates affected by these changes?

Other “IBORS” for other currencies may also be impacted. Certain currencies also use specific benchmarks such as EURIBOR and EONIA for EUR, the Tokyo Interbank Offered Rate (TIBOR) for JPY, the Hong Kong Interbank Offered Rate (HIBOR) for Hong Kong Dollar and the Singapore Interbank Offered Rate (SIBOR) for Singapore Dollar.

EURIBOR (Euro Interbank Offered Rate) has been reformed to comply with the EU Benchmark Regulation and there are no current plans to discontinue it. However, cash fallbacks might need to be strengthened in light of regulatory guidance and some products may transfer to other Euro rates.

EONIA (Euro Overnight Index Average) has been reformed and since 2nd October 2019 has been quoted as Euro Short Term Rate (€STR) plus a fixed spread of 0.085%. It is scheduled to be discontinued from 3rd January 2022.

TIBOR (Tokyo Interbank Offered Rate) has been reformed and will continue to exist alongside TONAR.

HIBOR (Hong Kong Interbank Offered Rate) has been subject to a number of reforms. Hong Kong Overnight Index Average (HONIA), which was a pre-existing rate, has been identified as the alternative RFR but there is no plan to discontinue HIBOR. HIBOR and HONIA will therefore co-exist.

SIBOR (Singapore Interbank Offered Rate) is expected to be discontinued, with an anticipated transition to the Singapore Overnight Rate Average (SORA), a pre-existing overnight rate.

What are the main differences between LIBOR and near risk-free rates (RFRs)?

LIBOR rates are forward-looking for certain identified terms (eg 1 month, 3 months etc.) RFRs are point in time overnight rates. An example of an RFR is SONIA (Sterling Overnight Index Average).

LIBOR prices in term risk and bank credit risk whereas the RFRs do not. RFR interest payable over a period is typically calculated by daily compounding a series of overnight rates with the interest due being calculated at the end of the relevant interest period, rather than at the beginning. As term risk and bank credit risk are not included in RFRs, an adjustment spread may be added to the compounded RFR. This is known as a credit adjustment spread (CAS) which is explained separately at question 13.

What is Base Rate?

The Bank of England Base Rate is a stable central bank rate which is widely recognised and respected by the UK business banking market. It is one of the most important interest rates because it tends to influence all other interest rates, such as those set by banks, including mortgage, loan and savings rates and rates for businesses.

It is a variable rate, set by the Bank of England’s Monetary Policy Committee (MPC) and reviewed by them a minimum of 8 times per year. It's part of the monetary policy action taken by the Bank of England to meet the target that the Government sets them to keep inflation low and stable. The minutes of the MPC meetings are published after each meeting (even when no rate change takes place) which allows the market to review the sentiment of its members to current and future rate movements. The dates for 2021 MPC announcements can be found here:

Monetary Policy Committee dates for 2021

Base Rate influences the cost of borrowing for banks and the rates those banks charge customers to borrow money or pay on their savings. Should Base Rate rise during the term of the facility, the total interest cost on the facility will increase. Should Base Rate fall during the term of the facility, the total interest cost on the facility will decrease. Interest rates can also change for other reasons and may not change by the same amount as the change in Base Rate.

The link below provides additional information:

Please contact your Relationship Manager for details of the Base Rate products we offer.

What is SONIA?

SONIA (Sterling Overnight Index Average) is a risk-free rate based on actual transactions and reflects the average of the interest rates that banks pay to borrow sterling overnight from other financial institutions and other institutional investors. It is a backward-looking, overnight rate based on the average of actual wholesale deposit transactions that have taken place the day before.

The definition of SONIA has two elements:

- Statement of underlying interest

- Statement of methodology

SONIA is a measure of the rate at which interest is paid on sterling short-term wholesale funds in circumstances where credit, liquidity and other risks are minimal.

On each London business day, SONIA is measured as the trimmed mean, rounded to four decimal places, of interest rates paid on eligible sterling denominated deposit transactions.

The trimmed mean is calculated as the volume-weighted mean rate, based on the central 50% of the volume-weighted distribution of rates.

SONIA is the recommended risk-free rate for sterling but you wouldn’t be charged interest on the basis of that “raw” SONIA rate. SONIA compounded in arrears with a 5 business day lag (also known as SONIA compounded in arrears without observation shift) is the recommended alternative reference rate for larger and more complex borrowers.

Because SONIA is a backward-looking, overnight rate, in order for you to:

- Pay accrued interest for an interest period at the end of that interest period in line with normal conventions, the daily SONIA rates are compounded during the course of that interest period; and

- Know before the end of an interest period how much interest that you will need to pay at the end of that interest period, the calculation is done by looking back to the rates in a period that “lags” the corresponding interest period. That means we can tell you how much interest you will pay for an interest period shortly before the end of that interest period.

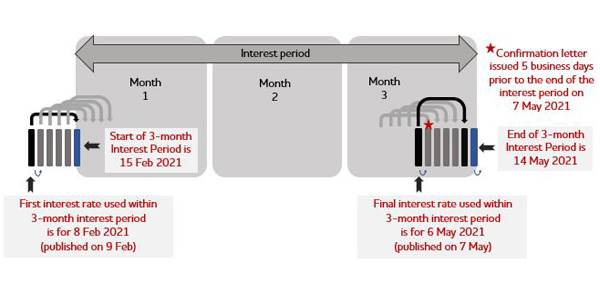

How does 5 business day look back without observation shift work?

When calculating the interest charge for a SONIA compounded in arrears with lag facility for an interest period, a 5 business day look back will be performed.

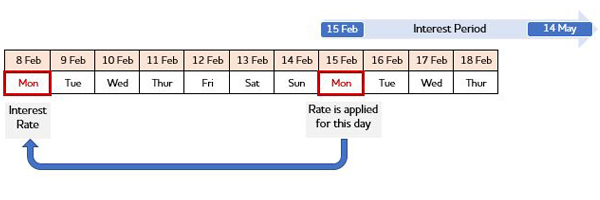

For example, if an interest period starts on 15th February 2021 (Monday), the applicable rate for the first day of that interest period will be the rate for 8th February 2021 (the previous Monday) which is published on 9th February 2021 (the previous Tuesday). The same process is repeated through that interest period. This is illustrated below.

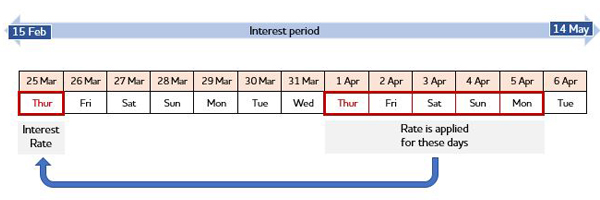

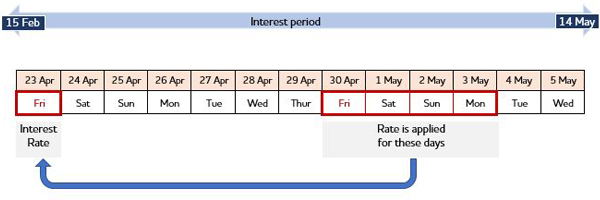

For day X in an interest period, the rate is weighted depending on how many days there are from day X until the next business day in that interest period. If day X is followed by another business day in that interest period, the weighting is 1 and the daily SONIA rate that is used for day X will be applied for one day. If not, the daily SONIA rate will be applied (i.e. weighted) for the number of days that follow day X until the next business day in that interest period (meaning that for a Friday the weighting would typically be 3).

The last day of an interest period is also the first day of the next interest period, therefore:

- The interest due in respect of the last day of an interest period is charged as part of the next interest period;

- The penultimate day of an interest period is the last day on which interest is charged;

- We can calculate and confirm to you the interest rate and interest due 5 business days prior to the end of an interest period.

In the first example of the above illustration, 15th February is a Monday. Therefore, the weighting is 1 as the following Tuesday (16th) is a business day and the daily SONIA rate applicable for 8th February would be applied once for the interest period in respect of 15th February.

Any bank holidays which occur in an interest period will also affect the weighting. In the second example below, 1st April is a Thursday, and this is followed by four non-business days in that interest period comprising of Bank Holiday Friday, Saturday, Sunday and Bank Holiday Monday. Therefore, the weighting applied would be 5; ie the daily SONIA rate applicable for 25th March will be applied 5 times for the interest period in respect of 1st April/2nd April/3rd April/4th April/5th April.

In the final example below, 30th April is a Friday, and this is followed by three non-business days in that interest period comprising of Saturday, Sunday and Bank Holiday Monday. Therefore, the weighting applied would be 4; ie the daily SONIA rate applicable for 23rd April will be applied 4 times for the interest period in respect of 30th April/1st May/2nd May/3rd May.

The links to the Bank of England website below provide more details on SONIA and its methodology:

SONIA key features and policies

Statement on recommendations for SONIA loan market conventions

UK loan conventions supporting slides

Please contact your Relationship Manager for details of the SONIA products we offer.

What is a Fixed Interest Rate?

A fixed interest rate is an unchanging rate which remains the same throughout a set fixed rate period. Should market interest rates rise or fall throughout this period, the interest rate applicable to the facility will be unchanged. The total interest cost is calculated at the beginning of the relevant interest period.

A fixed rate early repayment charge may be applied where changes are subsequently made to the terms and conditions agreed at the start of the interest rate period, eg if the timing or amount of the agreed repayments are varied. The amount of this fee may be substantial and is usually dependent on market interest rates at the time of making the changes.

Please contact your Relationship Manager for details of the fixed rate products we offer.

What is a Credit Adjustment Spread (CAS)?

Existing LIBOR rates include a credit risk premium to reflect the costs and risk to banks of lending over a term period (e.g. one month or three month LIBOR). Because SONIA and other alternative reference rates are derived from overnight rates, they do not have that risk premium built into the rate, and banking regulators have confirmed that a small adjustment is needed to take account of the differential in the alternate rate methodologies. That differential is known as a “credit adjustment spread”.

There is no standard market convention for calculating the CAS for facilities actively transitioning prior to cessation of LIBOR. Based on loan transactions executed to date and approaches taken in the bond and derivatives markets, two key methodologies have emerged:

- the five-year historical median approach; and

- the forward approach (based on the forward-looking swap market).

Backward Looking 5-year Historic Median (5YHM)

Under this approach, the CAS is based on the difference between GBP LIBOR for a particular interest tenor (e.g. 1/3/6 months) and SONIA compounded in arrears over the same period, calculated using a median over a five-year lookback period. This approach looks into the past, i.e. the historical differences between GBP LIBOR and the SONIA compounded in arrears rate over a five-year period.

In line with recently established market practice, CAS calculations using this method will be fixed as at 5th March 2021 (as this was the date that the FCA made a pre-cessation announcement confirming the date on which LIBOR will lose its representativeness). This effectively “locks” the rate.

Backward Looking 5-year Historic Median - Credit Adjustment Spread Values set as at 5th March 2021:

Where this method applies, any loans that are transitioned from GBP LIBOR to SONIA would be priced at SONIA compounded, plus the applicable CAS, plus the existing margin.

Forward Looking Approach

This approach involves calculating the CAS based on the forward-looking basis swap market. It is calculated as the linear interpolation between differing tenors of GBP LIBOR vs SONIA swaps, which is then added to the original margin. The tenor of basis used should match the weighted average life of the existing loan (eg the tenor of the loan if it has a bullet repayment, or shorter if it has an amortising repayment profile).

The following link provides guidance from the Bank of England’s Sterling Risk Free Rate Working Group (which we’ll refer to as the RFRWG) to explain the concept of a CAS and why it is required:

What is Credit Adjustment Spread?

This link confirms the most up to date guidance from the RFRWG on the calculation and application of CAS:

Credit Adjustment Spread methodologies for fallbacks in cash products referencing GB

Countdown: 2021

What timetables are in place for the transition away from LIBOR?

As a reminder, the RFRWG targets and roadmap for transition are:

- October 2020: new and re-financed GBP LIBOR referencing loan products must include clear contractual arrangements to facilitate conversion to the non-LIBOR alternative reference rates ahead of the end-of-2021 deadline, where maturity is after 2021;

- By end of March 2021: firms to cease issuance of GBP LIBOR referencing loans, where maturity is after 2021;

- Contracts expiring after 2021 should be actively converted, where viable, by the end of September 2021; and

- The Bank of England (BoE) has mandated the complete cessation of the use of the GBP LIBOR reference rate in calculating interest by 31 December 2021 and mandated the use of alternative reference rates.

In line with the RFRWG recommended milestones, we no longer offer new GBP LIBOR-linked loans after 31st March 2021. This milestone applies to all GBP-linked bilateral and syndicated new lending, as well as the amendment or refinancing of existing facilities which from 1st April 2021 must instead be linked to an alternative reference rate.

How is Clydesdale Bank preparing for the transition from LIBOR?

We have written to all existing customers who hold a product referencing LIBOR to make them aware that LIBOR is phasing out and we have already begun to contact some customers to advise them of their transition options. If you have not heard from us, we will be in contact shortly.

We are continuing to work through the required actions to ensure a smooth transition to alternative rates. We are represented on a number of industry forums, providing feedback alongside other banks and relevant firms.

As instructed by the Bank of England Prudential Regulatory Authority (PRA) and the UK Financial Conduct Authority (FCA), we are planning for the scenario that LIBOR will no longer be available after 2021.

What this means for you

Why are we telling you about LIBOR cessation now and how will it impact you?

Although the final date for LIBOR cessation is 31st December 2021, it is important that you understand how the transition from LIBOR to alternative reference rates may affect you.

Existing LIBOR-linked products that are due to mature before the end of 2021 will run to maturity using LIBOR, unless they are refinanced.

If you have LIBOR-linked products maturing in 2022 and beyond, we will be in touch to discuss the impacts of this and the options available to you. If required, contracts will need to be updated to in order to accommodate the future switch to an alternative rate by the end of 2021.

What can you do to start preparing for the transition away from LIBOR?

The transition away from LIBOR is complex and will affect both new and existing products. We encourage you to keep up to date throughout the transition period, evaluate your own individual circumstances and review your LIBOR-linked exposures and the impacts on your business.

Where appropriate, you may wish to consider using independent professional advisors for guidance on the implications of the changes from an accounting, tax or legal perspective.

Can you make the transition now?

We have already begun to contact customers who will be impacted by this change. If you have LIBOR-linked products maturing in 2022 and beyond, we will contact you to discuss your transition options. If you have any questions please contact our LIBOR transition team at CYBG LIBOR Transition Programme.

Useful industry links

UK Finance has developed a useful guide for business customers to help prepare for the cessation of LIBOR:

Disclaimer:

These FAQs have been produced by Clydesdale Bank and are provided for information purposes only and are subject to change. It should not be treated as (and we will not provide you with) a recommendation, opinion or advice. You should consult your own advisers (which may include your financial, tax and/or legal advisers) if you have questions about the impact of any of this information and your individual circumstances.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

You should be aware that Clydesdale Bank has adhered to the ISDA IBOR Protocol for its derivative hedging operations. If you also decide to adhere to the IBOR Protocol, legacy transactions you have with us that are within the scope of the IBOR Protocol such as Sterling LIBOR swaps will automatically be amended in accordance with the IBOR Protocol. It is not necessary to adhere to the IBOR Protocol in order to amend legacy LIBOR transactions with Clydesdale Bank as we will be in touch with you to discuss the options available to you. However, you need to make your own decision as to whether to adhere to the IBOR Protocol based on your individual circumstances, including your IBOR-linked exposures, and assess the potential risks of adhering versus not adhering, in each case either on your own or through independent professional advisors (legal, accounting, financial, tax, or other), as appropriate. Clydesdale Bank is not acting as your fiduciary or advisor and is not responsible for assessing the appropriateness or suitability for you of adhering to the IBOR Protocol or not.

Clydesdale Bank shall not be liable for any direct, indirect or consequential loss or damage suffered by any person as a result of relying on any statement in or omission from this document or in any other information or communications made in connection with the matters set out herein.

You can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.