-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Ways of banking More ways of banking links

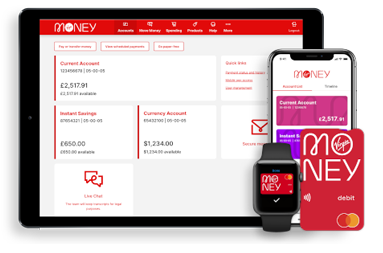

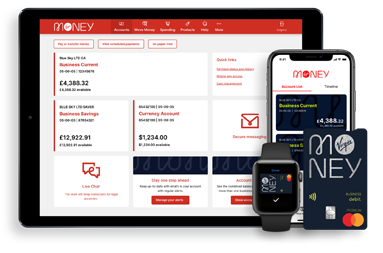

Internet banking

Mobile banking

Telephone banking

Branches, ATMs and Post Offices

Useful information

Easy-peasy payments

Just a fingertip away with Apple Pay

Tap, pay, go.

Google Pay is here

- Current accounts More current account links

Our current accounts

Choosing an account

Managing your account

Our bank accounts

Find out more and compare our range of accounts

Your application

Log in to complete your online application and get your online decision

Need Help?

- Current account help

- Help and support home

- Credit cards More credit card links

Benefits of a credit card

Useful information

Need Help?

- Credit card help

- Help and support home

- Savings More savings links

- Loans More loan links

- Mortgages More mortgage links

- Insurance More insurance links

Print2 year fixed rate Interest Only mortgage

For loans up to 75% of the value of your home.

Mortgage name 2 Year Fixed < £500,000 <=75% Interest Only BO1710 Max loan to value 75% Initial rate 4.23% Until Variable rate thereafter, currently 7.24% The overall cost for comparison is 7.00% APRC Product fee £499 for existing mortgage customers

£999 for new mortgage customersOption to add product fees to mortgage The product fee can be added to the loan, unless it takes a residential loan over 95% LTV or a BTL loan over 80% LTV. Legal fees You’ll normally instruct a solicitor to act on your behalf in connection with your transaction. You may be required to pay legal fees and costs as part of their work on your behalf. These fees/costs are normally charged by the solicitor directly to you, unless we tell you that we’ll contribute to the legal costs as part of your product deal.

Typically you will not need to pay legal fees if:

- you are an existing mortgage customer who wishes to re-mortgage with us.

- you are a new mortgage customer who wants to switch the mortgage for their current home to us and use our legal panel.

Valuation fee Purchase: One free valuation for properties up to £3m

Remortgage: One free valuation for properties up to £3m Free standard legals (excluding any fee charged by our preferred legal provider for transferring funds to the previous lender) for properties up to £2m

Properties over £3m – No incentives

All incentives are subject to qualifying criteria being met.

Special features At the end of the fixed rate period, additional payments or increased monthly payments may be made without charge.

Early repayment charge Applies for the first two years

3% in year 1

2% in year 2Eligibility Applicants must be aged 18 or over. All loans are subject to status. Security will be required. Your home may be repossessed if you do not keep up repayments on your mortgage

Work out your monthly repayment for this mortgage

During the initial period, your estimated monthly repayments would be: £ until

Thereafter, the rate would revert to our variable rate, currently 7.24%, which equates to a monthly payment of £

The overall cost for comparison is:

% APRC

Our mortgage calculator gives you an indication of monthly mortgage repayments. If you'd like to discuss your individual circumstances or obtain a personalised illustration, please contact us.

Next steps

You can switch to this mortgage online if:

- You don't want to change your borrowing amount.

- You want to keep the same term.

- You don't want to add or remove any parties to or from the mortgage.

- You don't want to change the repayment method.

- You still use the property in the same way eg. it's still your main home.

- You can still meet your mortgage repayments.

- The mortgage term does not run beyond when you expect to retire from work.

- You do not rely on any of the following to make your mortgage payments and/or (in the case of interest only mortgages) to repay the balance that will remain outstanding at the end of the term:

- income received in a currency other than pounds sterling; or

- assets held in a currency other than pounds sterling (including non-UK property or land)?

Please note to switch online you will need your mortgage account number. You can find this on your mortgage statement or other mortgage related letters.

I confirm I have read the above information and I am happy that I can continue.

Click to confirmOr if you would like to speak to one of our mortgage advisors, you can give us a call on 0800 916 0566 (we're open 8am - 8pm Monday to Friday, 9am - 5pm Saturday and 10am - 4pm Sunday) or:

Arrange a callbackTalk to us

Get in touch to discover how our advisors can help you live where you love.

Phone

0800 022 4313We're here Mon-Fri 8am-8pm, Sat 9am-5pm and Sun 10am-4pm

Find out your mortgage borrowing potential

You are here: Personal Banking > Mortgages > Fixed rate

- About Clydesdale Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more. - Insurance More insurance links