Frequently asked questions

Coronavirus support for personal customers

If you've been affected by coronavirus (due to illness or self-isolation) and are worried about what this might mean for you financially, there are things we can do to help.

Please get in touch with us as soon as possible so we can discuss your individual circumstances and find ways in which we can support you. The sooner you contact us, the more we can do.

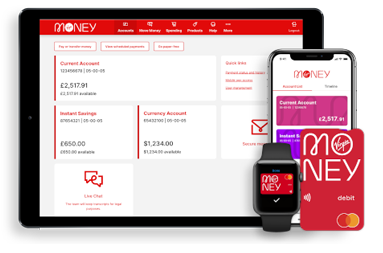

It's also worth remembering you can bank from home or on-the-go with internet banking and our mobile app - move money, check your balance or even pay in a cheque with just a photo.

*Call charges may vary. For your protection calls may be monitored and recorded.

General enquiries

Would a UK outbreak affect how I manage my money and access my account(s)?

We offer a number of ways to manage your money, including our mobile app and internet banking. If any of those are affected, we’ll let you know. You can check our service status page to see how our services are running.

If anything changes, will you let me know?

Stores - If we need to close any of our stores temporarily, we’ll let you know on our website, social media or via email if we hold a valid email address for you.

Remember, you can manage your money using internet banking or our mobile app. They’re great alternatives if you’re unable to visit a branch or speak to us on the phone.

I’m currently stuck in a foreign country impacted by coronavirus

We appreciate that as a result of coronavirus, you may have some unexpected worries about your finances. Supporting our customers is our absolute priority and we want to help. So if you have any worries about your finances as a result of coronavirus or any other circumstances, please contact us on the phone number on the back of your card and we can talk through your personal situation and consider how best to help, we’re here 24/7. Options could include extending your credit facility and freezing interest payments, we’ll work through the right option for you. Also remember that you can request an additional credit facility via the Virgin Money Credit Card Online service. This service is available to Virgin Money customers only.. The sooner you contact us, the sooner we can provide you with the right support.

Where can I find the latest medical information about coronavirus?

I’m self-isolating and need to get cash out. How can I do this safely?

Those who are self-isolating now have access to take out cash through your local Post Office. The new temporary service during Covid 19 lockdown includes an arrangement which will allow a trusted third party to collect money on your behalf from your local Post Office should you have no alternatives.

Please contact us to discuss if you want to access this service and the team will discuss the terms with you. As this is a temporary service during Covid 19 we will review it’s availability and can discuss alternative options if this option is removed.

Clydesdale Bank Contact Centre, Monday to Friday 8am - 6pm, 0800 121 7365.

Call from abroad, +44 141 221 7300.

Savings

What if I need to access my fixed deposits?

We appreciate that as a result of coronavirus, you may have some unexpected worries about your finances. Supporting our customers is our absolute priority and we want to help. So if you have any worries about your finances as a result of coronavirus or any other circumstances, please contact us and we can talk through your personal situation and consider how best to help. The sooner you contact us, the sooner we can provide you with the right support.

Can I get a Statement of Credit Interest for my account?

Yes, you can request a Statement of Credit Interest for the most recent tax year online.

You’ll need to contact us to request a Statement of Credit Interest for an earlier tax year.

Bank of England base rate changes

I have a base rate tracker savings account with Clydesdale Bank- when will my interest rate change?

If you hold any product that states in its Terms & Conditions that its interest rates are linked to base rate, then the interest rates will have been reduced on the business day after the Bank of England change. The reductions that took place were by 0.50% on 12th March and a further 0.15% on 20th March 2020.

The Base Rate Tracker products impacted by these changes were;

- Headstart,

- Current Account Tracker

- Private Current Account

- Private Savings Account

- Academy

- Business Choice Charity.

- Regular Home Saver,

These new rates were advertised in local and national press and will show on the next statement after the change.

I have a variable savings account with Clydesdale Bank – is my interest rate going down because of the base rate change?

Following the Bank of England base rate changes on the 11th and 19th March, we are lowering the interest rate on some of our variable rate savings accounts. We love to give our savers good value and are confident these new rates do exactly that in the current market.

- Existing variable rate account customers will get two months’ notice of their rate reduction, with a reminder sent 14 days before the rate goes down.

- New variable rate account customers will be advised at the point of sale of both the current rate and the future rate.

If your rate is reducing, your letter or email will show your new rate and the date it kicks in.

I have a fixed rate savings account with Clydesdale Bank. Will my rate change?

No - your savings rate is fixed for all of the term. This is usually one, two, three or five years. Any new rates will be advised to you when you receive your maturity information.

I have a Virgin Money Current Account or Current Account Direct with you – is my interest rate going down as a result of the base rate change?

Following the Bank of England base rate changes on the 11th and 19th March, some current account products will be subject to a rate change. We love to offer good value for our customers and we’re confident these new rates do exactly that in the current market.

In line with your account terms, if we decrease the rate on your Current Account Direct or Virgin Money Current Account or its linked savings account, you’ll get two months’ notice of the rate reduction. For the linked savings account, we’ll also send you a reminder no more than 14 days before it starts.

If your rate is changing, your letter or email will show your new one and the date it kicks in.

Is Clydesdale Bank passing on the Bank of England base rate reduction in full?

This is an unprecedented situation, with two Bank of England base rate changes very close together. Because of this, we’re lowering the interest rate on a number of our variable rate savings accounts. This change reflects both base rate reductions at the same time. The amount the rate is reduced by differs between accounts so that we continue to offer good value in the market. We’ve also made sure that all affected accounts are paying more than base rate. If your rate is changing, we’ll let you know the new one and the date it starts.

The Bank of England reduced its rates twice during March. Does this rate reduction cover both of the base rate changes or should I expect another letter in a few weeks’ time?

Due to the Bank of England changing rates twice in quick succession, we’ve taken both changes into account when deciding on the new variable rates. The letter you’re getting now covers both rate reductions. We don’t have any plans to reduce rates again at the moment.

As always, we’ll continue to look at the market to make sure your savings account offers good value. And we’ll always tell you about any more changes with the right amount of notice.

Will you write to me to confirm my new interest rate?

Yes – we’re contacting every customer that is affected by this rate change. If we hold a valid email address for you, we will endeavour to advise you by email. If this is not possible or you have not provided us with an email, you will be sent a letter.

- Existing variable rate account customers will get two months’ notice of their rate reduction, with a reminder sent 14 days before the rate goes down.

- New variable rate account customers will be advised at the point of sale of both the current rate and the future rate.

Are you changing the interest rates on all of your savings accounts at the same time?

Our savings range is reviewed on an account-by-account basis - interest rates may move by different amounts and at different times. This is to make sure they offer good value in the savings market.

We’re writing to customers whose interest rates are going down. For a small number of our accounts, the interest rates are still being looked at. We’ll write to those customers once any decisions are made, giving the right amount of notice.

I have not received a letter about my savings account - does this mean it’s not changing?

We haven’t made a decision about the interest rates on some of our savings accounts yet. If we decide to change the rates on these accounts, we’ll let customers know as per their terms and conditions. All rates that are changing are being pre-notified on our website.

I’m not happy that my interest rate is being reduced at this difficult time - what can I do?

We’re sorry when anyone is unhappy. But it’s worth knowing that, as an existing customer, you can open any account that’s available to a new Clydesdale Bank or Virgin Money customer. So, if there’s an account you feel is more suitable, you’re free to open one of those.

During this particularly busy period, please view our savings range online and choose the best online account to suit your needs. You can apply for this yourself and ask us to move your money after.

Alternatively, you can withdraw funds from your savings account or close it.

To open a new current account - you can compare our accounts here

If you want to move to another bank, you can do so with the Current Account Switch Service. It’s a secure and easy way to move in just seven days. If you hold a linked savings account with your current account, remember this isn’t covered by the Current Account Switch Service and you will need to arrange to close or convert this before your switch.

If you would prefer to speak to someone in your local branch, please check Branch opening times before making your journey. We may have reduced opening hours because of the current coronavirus situation.

I have a notice account, how should I apply notice to withdraw my funds without penalty?

If you want to serve notice to withdraw from your account or close it, just let us know in writing or by calling in to a branch. If you wish to close your account when the notice expires, please include this information when you send your withdrawal or closure instruction.

I would like to speak to someone about my rate change notification

Before you contact us

During these difficult times, we're getting more calls than usual. Our priority is to protect our services for customers that need us the most. If your call or branch visit isn’t urgent, please keep the way clear so we can help them first.

Our branches and phone lines are still open. However, as more of our colleagues become personally affected by the coronavirus situation, we’ve made some changes to our opening hours for our branches and contact centres.

If you’re going out, please make sure you follow Government guidelines.

Data Subject Access Request (DSAR)/Rights Requests

What’s the latest update on a DSAR/Rights request?

As of 22 June our DSAR team is once again operational following a brief pause as a result of the Coronavirus. We are working through the requests, however please be aware that we are currently responding beyond the usual timeframe expected. We thank you for your patience during this time. Please be assured that we are working to issue your response as quickly as possible.

Personal Loans

Can I still apply for a personal loan payment holiday?

Payment holidays were a temporary solution made available during the Coronavirus outbreak. The deadline for applying for a new payment holiday was the 31st March 2021. As this deadline has passed, we can no longer offer payment holidays.

If your initial payment holiday is not due to end until after the 31st March 2021, you can still apply for a payment holiday extension (up to a maximum of 6 months). No payment holiday can continue beyond the 31st July 2021. To apply for an extension to your payment holiday you'll need to complete the online form.

If you are worried about not being able to make your next payment or your finances in general, please call us on 0800 141 2261. We can discuss your agreement and explain what options are available to you.

If you have had a change in circumstances, or if you have multiple creditors, then you may want to consider getting some free independent financial advice or help on dealing with all your creditors from one of the following agencies

- StepChange Debt Charity – www.stepchange.org

- National Debtline – www.nationaldebtline.org

- Citizens Advice Bureau – www.citizensadvice.org.uk

- Money Advice Service – www.moneyadviceservice.org.uk

What is the maximum Payment holiday duration?

The maximum duration of a payment holiday was 6 months, applied in periods of up to 3 months.

If you're currently in the first 3 month period of a payment holiday that expires after the 31st March and would like to apply for an extension, please complete the online form.

If you have already had a 6 month payment holiday and are concerned about your ability to maintain your loan repayments please contact our financial care team on 0800 141 2261 to discuss how best we are able to help.

What will happen to the interest on my personal loan during my payment holiday?

You won't be charged any additional interest over the term of your loan by taking a payment holiday.

What if I pay by Standing Order or Direct Debit?

If you pay by Direct Debit, it will be suspended and we won’t take any payments until the payment holiday has ended.

If you have cancelled your own Direct Debit you'll need to re-instate it prior to the end of your payment holiday, the date will be notified to you by post.

What happens when my payment holiday ends?

At the end of the payment holiday, your contractual repayments will resume, and the term of your loan will be extended to cover the duration of your payment holiday.

We'll write to you around 4 weeks before the end of your payment holiday to confirm when your next payment is due.

Will this affect my credit rating?

Your payment holiday won’t affect your credit file, but lenders may look at your account and payment history when making decisions about your credit in the future.

My payment holiday is coming to an end and I can't make my next payment, can I extend my payment holiday?

If you are currently in payment holiday & have not yet benefitted from the maximum 6 months payment holiday available you can still apply for a payment holiday extension (up to a maximum of 6 months) by completing the online form. No payment holiday can exceed past the 31st July 2021.

If you are worried about not being able to make your next payment or your finances in general, please contact us on 0800 141 2261 . We can discuss your account and explain what options are available to you.

You can also get free independent financial advice or help from a number of charities and not-for-profit organisations, like the ones listed below: (list on current live site).

You can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.